Through most of my 20’s, I did not invest. I was eventually convinced to put money into a Roth IRA, but I never actually invested. My naïveté meant I sent money to a settlement account, where it promptly did nothing for years on end.

So, this is a post for my 20-year-old self, on what to do differently, next time.

Open a Fidelity account, I opened a Vanguard account originally, but it’s too confusing to use. You’re going to just end up ignoring it and get more and more anxious as you avoid using the platform to invest. Here’s what you’re going to do.

- Setup automatic transfers

- Setup automatic investing

- Spread investing across core ETF’s

Open An Account

You already have a Roth IRA with Vanguard, but you want to transfer it to Fidelity, so go here to do a “transfer of assets”. Doing it this way will protect tax benefits such as transferring your 401k or Roth IRA.

Investing

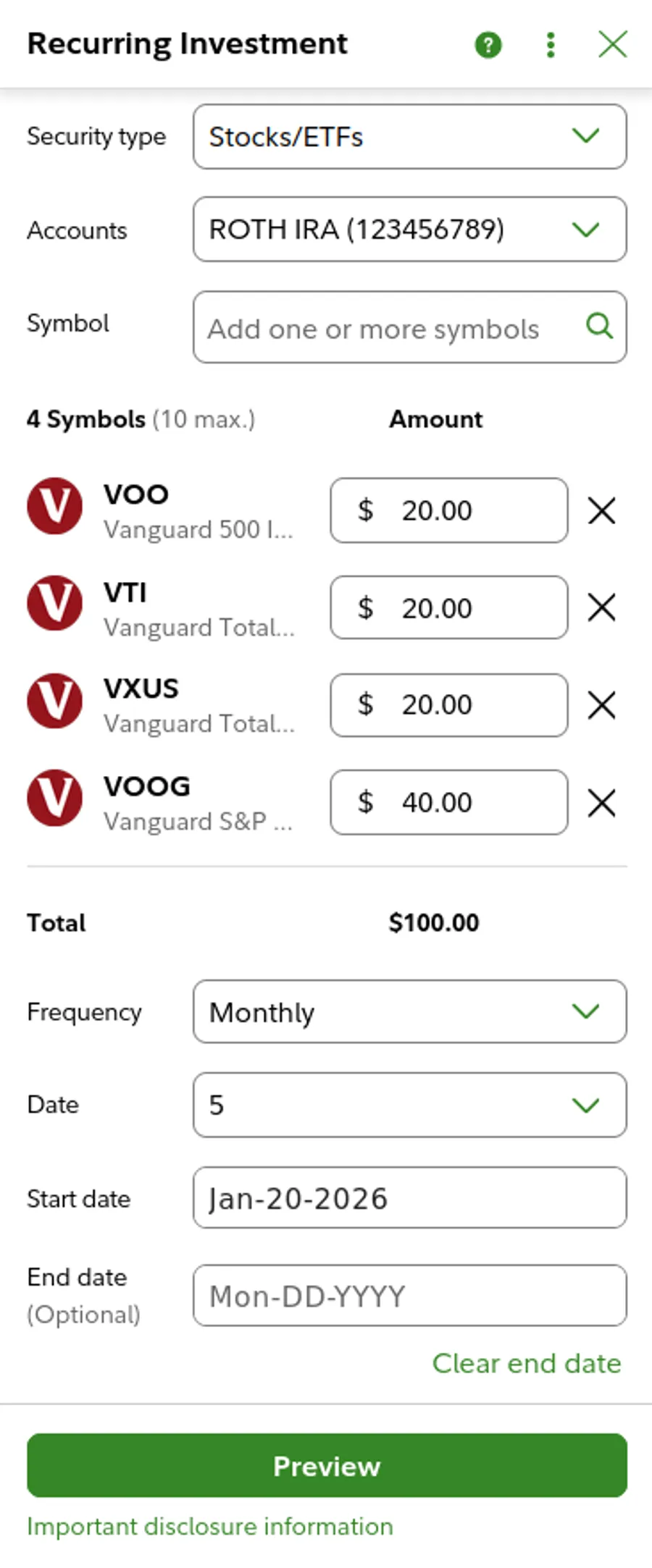

You don’t care about where the money goes. But you do want it to be smart. You don’t want to just lose all the money through bad investments. This has happened to people you know, so I know you’re wary. So, allocate it out like this:

| Stock | Name | Type | Amount |

|---|---|---|---|

| VOO | Vanguard Index Funds S&P 500 | Stable | 20% |

| VTI | Vanguard Index FDS | Stable | 20% |

| VXUS | Vanguard Total International | International | 20% |

| VOOG | Vanguard S&P Growth | Unstable | 40% |

You’re looking to keep things stable, so put 40% into the stable funds. It’s also good to have some international stock, as a stabilizer in case domestically things become unstable. Finally, growth stocks are risky, but that’s fine, you have time.

Over time, you’re going to want to move to stable stocks from the growth ones. You know, in 10-20 years from retirement.

Automatic Investing

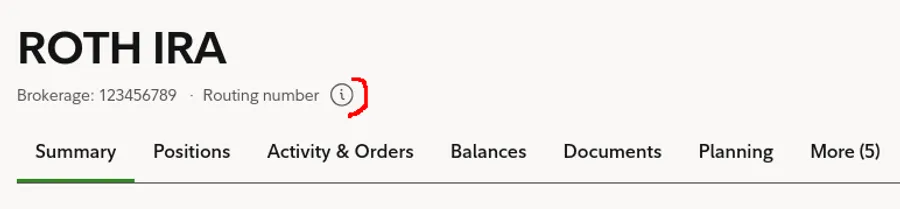

Firstly, check with your employer. Can they split your direct deposit straight to your investment account? If so, do it. Money you never see is money you don’t miss. If not, set up your bank with an external account. You’ll need your account number & Fidelity’s routing number. You can find this in the summary, next to the spot that says routing number, click on the (i) information symbol.

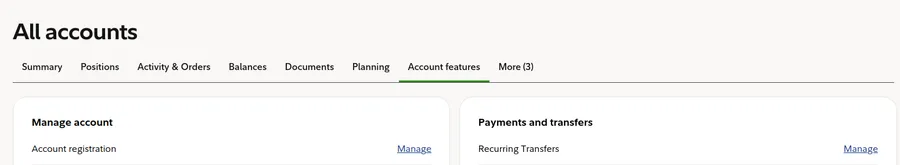

My mistake was forgetting (or wanting to forget) how to invest. I didn’t want to lookup which stocks were right each year or so. So, you’re going to setup automatic investing. In Fidelity, you can currently do this by:

- Going to All accounts

- Clicking on Account features

- Click on Manage by Recurring Transfers

- Click on Create new activity -> Investment

- Fill out the form

- Click on preview and verify the information is correct

For this form, we’ll do Stocks/ETF’s. Assuming a monthly investment of $100, we split it like the table below.

All Done!

That should be it. Feel free to investigate further to decide how you want to allocate funds, or don’t and come back in a couple of years to see things are doing. If you happen to forget about it entirely, that is fine too. At some point, something should remind you and you can check then.

But what is important is that you set this up as soon as possible. Each day you skip works against you when you consider compounding returns. Here, try for yourself:

Assume the following:

- Investing $500 monthly

- 5% return

- Retiring age 65

So you know, get on it.